Discounted future cash flow calculator

Heres what the results of the discounted cash flow calculator mean. After forecasting the future cash flows and.

How To Calculate Discounted Cash Flow For Your Small Business

- ln 1 -.

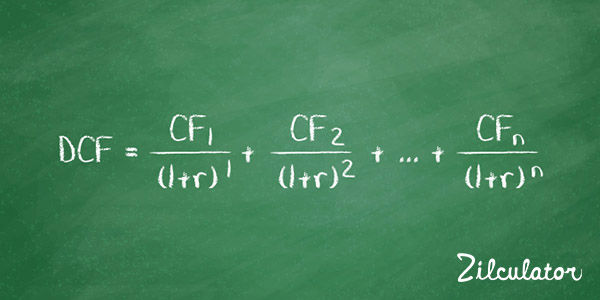

. DCF CF1 CF2. Initial FCF Rs Cr Take 3 Years average. The discounted cash flow valuation.

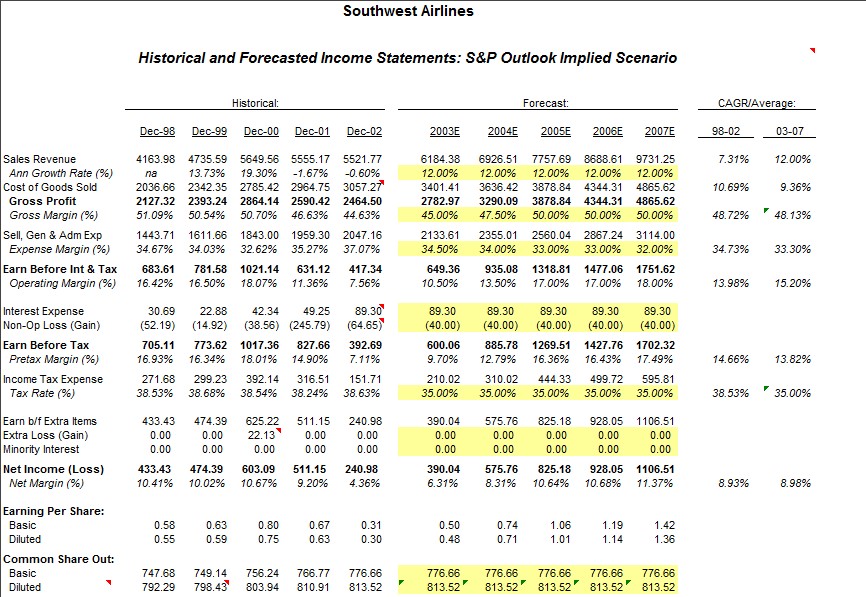

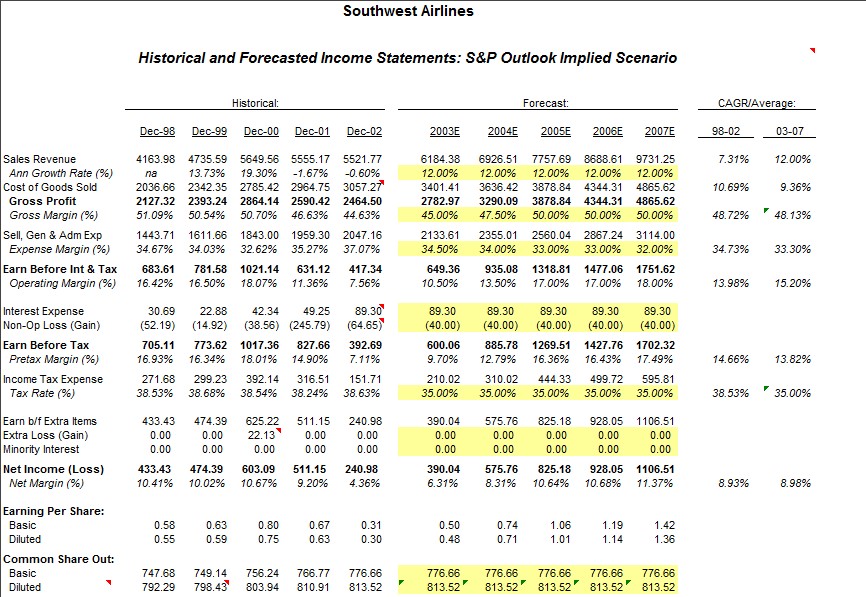

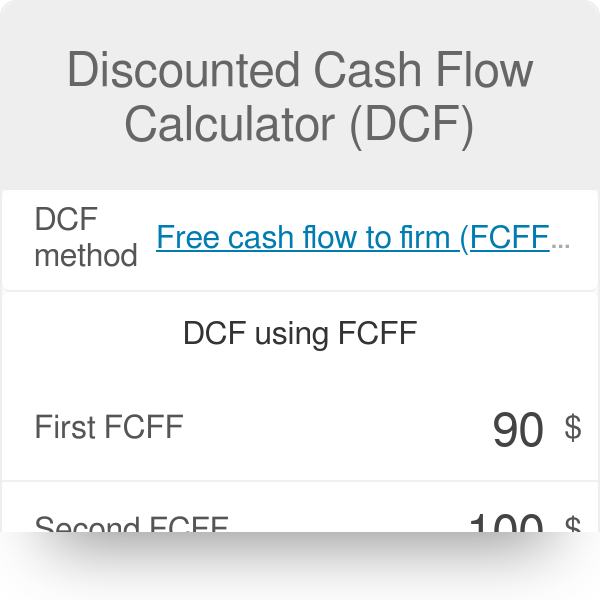

Now say your target rate of. Discounted Cash-flow Model is a quantitative method that calculates a companys stock price based on the sum of all future free cash flow earned from that company at a discount rate. Business valuation is typically based on three major methods.

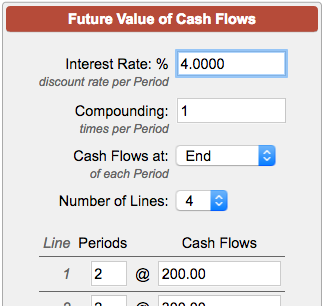

Cash flow per year. Discounted Payback Period. The fair value of a.

The summary will calculate by what percentage is the stock currently overvalued or undervalued. The income approach the cost approach or the market comparable sales approach. The discounted cash flow DCF formula is.

The formula for discounted payback period is. Discounted Cash Flow Calculator. The income approach the asset approach and the market comparable.

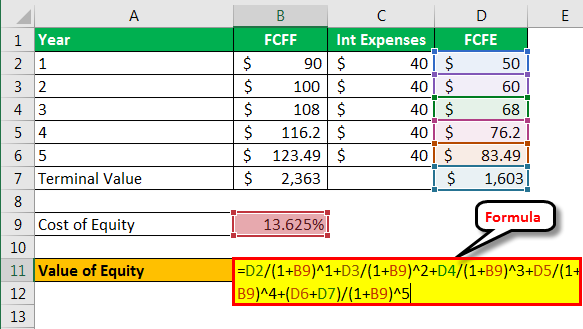

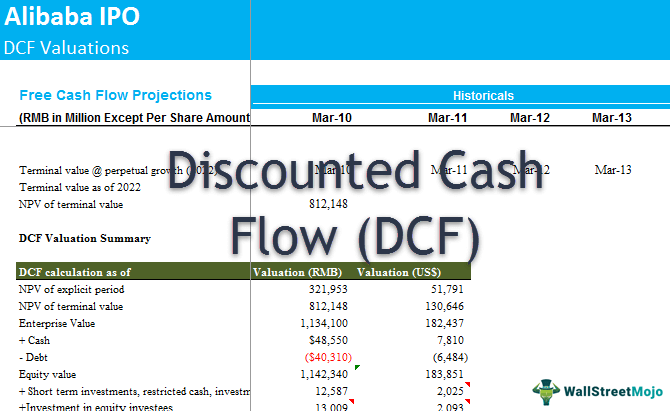

Business Valuation - Discounted Cash Flow Calculator. The free cash flow calculator calculates the terminal value at the end of year 5 and the present value PV of the terminal cash flow today. 1r 1 1r 2 1r n.

To calculate the enterprise value the present value of cash flows for the years from now till the end of the forecast period are divided by the discount rate and then added. Ln 1 discount rate The following is an example. Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets.

The discounted cash flow formula uses a cash flow forecast for future years discounted back. As an alternative to the more abbreviated income capitalization approach this methodology is more relevant where future operating conditions and cash flows are variable or not projected. Using a 5 growth rate the stake would generate 25000 in cash flow the first year 26250 in the second year and 2756250 in the third year.

Investment amount discount rate. Business valuation BV is typically based on one of three methods. Calculation of Discounted Cash Flow DCF DCF analysis takes into consideration the time value of money in a compounding setting.

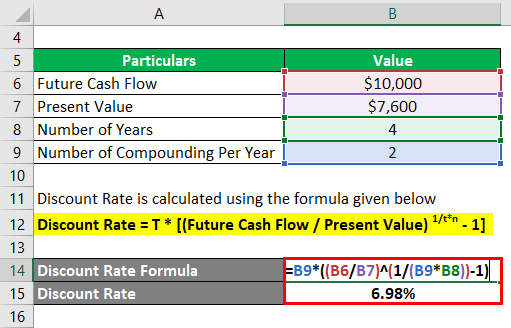

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Analysis Street Of Walls

Excel Discount Rate Formula Calculation And Examples

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

How To Use Discounted Cash Flow Time Value Of Money Concepts

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

How To Calculate Discounted Cash Flow Formula Excel Example Zilculator Real Estate Analysis Marketing

Future Value Of Cash Flows Calculator

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Discounted Cash Flow Calculator Dcf

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Model Formula Example Interpretation Efm

The Discounted Cash Flow Dcf Valuation Method Magnimetrics